washington state capital gains tax lawsuit

As estimated 7000 tax filers would pay the tax in 2023 if it. Washington was filed by a small group of.

Capital Gains Tax Constitutionality Tested In Court The Olympian

The sundial near the Legislative Building is shown under cloudy skies on March 10 at the.

. SEATTLE AP A lawsuit was filed Wednesday that seeks to block the new capital gains tax on high-profit stocks bonds and other assets that the Washington Legislature. The Washington State Supreme Court has announced it will hear arguments on Jan. In March of 2022 the Douglas County Superior Court ruled in Quinn v.

The capital gains tax passed the legislature in 2021s essb 5096. Aaron Kunkler September 10 2021. 26 to consider whether as previous courts have concluded on at least two previous.

A lawsuit filed against Washingtons 12 business tax on financial institutions could ensure taxpayers will pay the states new capital gains tax. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and. Last year the Legislature passed and Gov.

The next steps on whether Washington will remain income tax free will be in the courts as the I-1929 ballot campaign to repeal the capital gains income tax has suspended its. Given the legal facts the state supreme court should reject the latest attempt to circumvent the will of the people as clearly expressed in the constitution and at the ballot box. Filed by the Washington and.

Last May Clark Nuber published an overview of Washington states capital gains tax that takes effect on January 1 2022. The case will be heard in Tumwater due to renovations. Washington Supreme Court agrees to review capital gains lawsuit.

July 14 2022 1104 AM 3 min read. Thu July 14 2022. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business.

The measure adds a 7 tax on capital. The Washington State Supreme Court scheduled oral arguments for January 26 2023 on the capital gains lawsuit. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

The Washington State Superior Court on March 1 2022 overturned a new law enacted last year to tax capital assets. Shortly after the act was signed into law by Governor. The state Supreme Court will hear oral arguments in the capital gains income tax lawsuit on January 26 2023 at 9 am.

The opening briefs were filed yesterday in the capital gains income tax lawsuit. Former Washington Attorney General Rob McKenna filed a lawsuit Thursday seeking to strike down the states new capital gains tax arguing it is a stealthy and illegal income tax. 14OLYMPIA The state Supreme Court has agreed to hear a lawsuit regarding Washingtons new capital gains tax.

On Tuesday March 1 2022 Washington State Superior Court Judge Brian Huber released a ruling striking down the states new capital gains tax. 5096 which was signed by Governor Inslee on May 4 2021. A pair of legal challenges to Washington States capital gains tax will be allowed to proceed after a Douglas County judge tossed out the states.

Included was a declaration I submitted to the court detailing a decade of. The capital gains tax imposes a 7 tax on profits over 250000 in a year from the sale of such things as stocks and bonds. The lawsigned by Governor.

The suit Quinn v. The new law will. Jay Inslee signed into law a capital-gains tax aimed at the states wealthiest residents.

The capital gains tax took effect on January 1. For 2022 residents dont have to file a state estate tax return if the value of their estate is less than the tax exempt amount of 2193000 according to Washington inheritance.

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Judge Allows Capital Gains Tax Lawsuits To Proceed Washington State Wire

Second Lawsuit Filed Challenging Washington Capital Gains Tax King5 Com

In Washington State The Left Won A Major Victory For Taxing The Rich

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Washington State S New Capital Gains Tax A Primer Crosscut

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Former Attorney General Rob Mckenna Joins Lawsuit Seeking To Invalidate Washington State S Capital Gains Tax The Seattle Times

State Court Grants Edmonds School District Others Permission To Join Lawsuit Defending Education Funding Through Capital Gains Tax My Edmonds News

Washington State Capital Gains Tax Update Attorney General Seeks Appeal To Reinstate Controversial Law Geekwire

Washington State Ag Responds To Lawsuit Over Capital Gains Tax Washington Thecentersquare Com

Washington State S Capital Gains Tax Unconstitutional Rules Douglas County Court Mynorthwest Com

Washington Supreme Court Agrees To Review Capital Gains Lawsuit The Spokesman Review

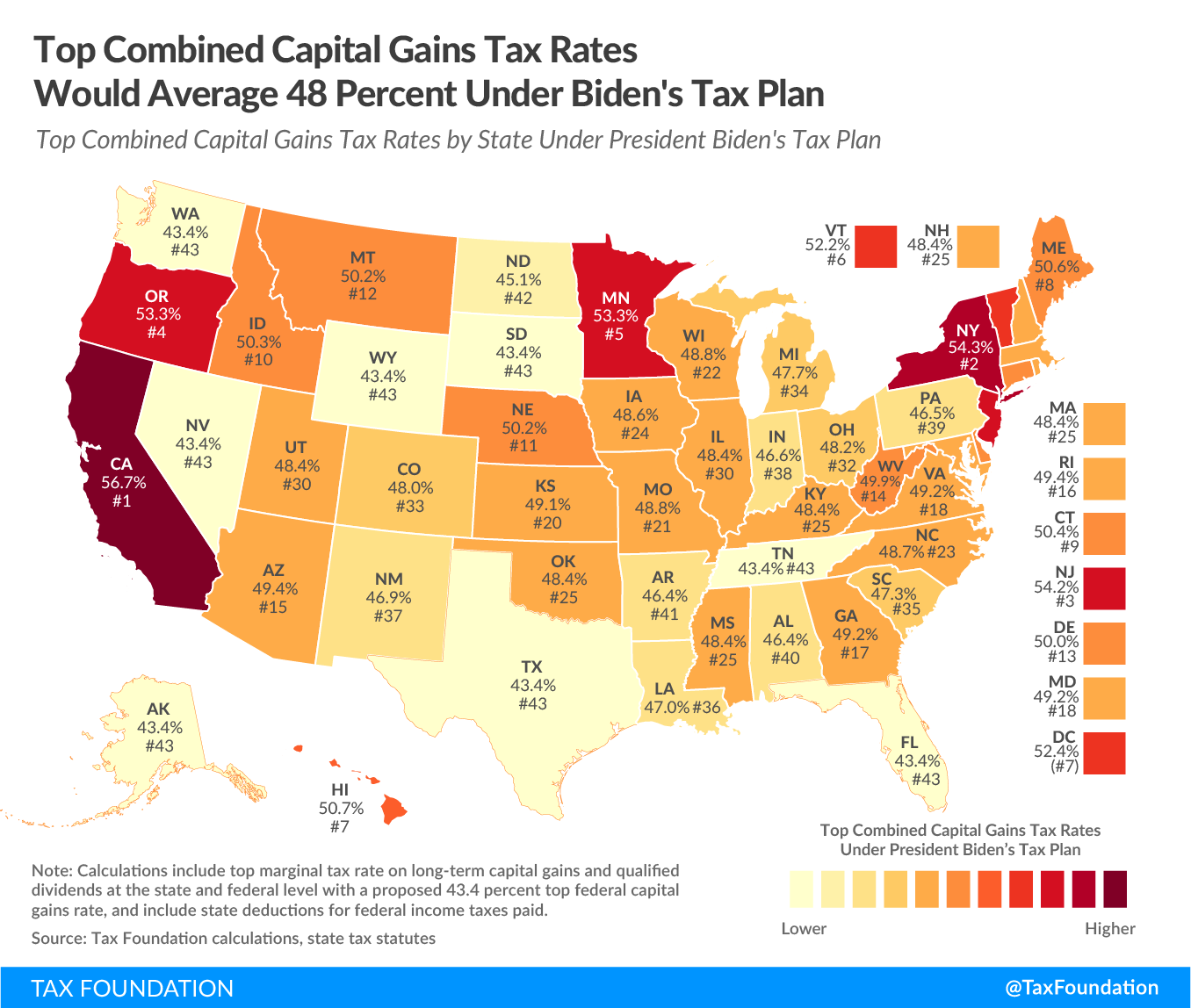

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Kuow Second Lawsuit Filed To Overturn Capital Gains Tax In Washington

How Would Gop Budget If They Controlled Olympia A Pair Of Spending Blueprints Offers Clues Northwest Public Broadcasting

Washington Supreme Court To Hear Challenge To New Capital Gains Tax Bypassing Court Of Appeals The Seattle Times

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Local Bigcountrynewsconnection Com